How To Get Approved For A Mortgage?

Content create by-Griffin MunksgaardIn order to qualify for a home loan, you need to first please a variety of criteria, including your earnings and debt-to-income proportion. You need to likewise have a good credit history. You should additionally recognize what a mortgage settlement suggests as well as what you can anticipate. Nevertheless, the goal is to acquire a mortgage that you can afford and stay in for the long term. Right here are some steps you can require to make the home loan procedure much easier as well as much less difficult.

Home loans are car loans that you check in return for a residential or commercial property. They are safeguarded by the residence's act. While https://bankingjournal.aba.com/2021/10/report-irs-reporting-provision-pulled-from-house-budget-bill/ do not own the home outright, you should make monthly payments to the loan provider. Normally, this suggests establishing an escrow account. This is a means to make sure that the lending institution gets his money. You don't own the house till the home mortgage is paid off completely. Commonly, your loan provider will send you an escrow account to collect this cash.

Although home loans are widely readily available, they differ in their attributes. While they're extensively standard, their features might be regulated locally. The rate of interest, as an example, might be taken care of for the life of the car loan or might vary and also higher or reduced. There are additionally different sorts of home mortgages, such as those with adverse amortization. A home loan that has dealt with rate of interest may not be the best choice if you intend to possess a property for a longer time period.

While a home loan can be a good option for some individuals, it is not an excellent concept for every person. The benefits of mortgages include the reality that you can allot funds for other financial investments, and also a home mortgage can maximize funds for various other expenses. The disadvantage of a home loan is that it is a long-term dedication that will certainly have a substantial effect on your finances. It is best to take into consideration every one of your options before making the decision.

When you have made the decision to seek a mortgage, you'll require to determine how much you can manage to pay every month. A lot of home loans have a monthly payment of rate of interest, which varies with the size of the car loan. You need to additionally recognize any type of constraints you have in location, such as paying home mortgage insurance coverage and residence insurance policy prior to you offer the building. A mortgage can likewise include a concept quantity, which stands for the preliminary amount of the lending. This quantity will certainly reduce in time as you repay the funding, which is after that paid off by the loan provider.

The regular monthly home loan payment will certainly contain a combination of rate of interest and also principal repayments. The interest section of the payment will certainly boost throughout the initial years, while the principal will certainly decrease as the car loan develops. You may likewise be responsible for paying home owners insurance coverage as well as property taxes. If you have sufficient cash saved up, the lending institution can maintain the cash from your home mortgage payment in an escrow account till you pay them. A home loan is not the same as a credit card, but it is a method to settle a finance a lot more easily.

The settlement made on a home loan will cover the primary amount of the lending, interest, tax obligations, and also insurance. In addition, there are other costs you might need to pay. The complete repayment will boost or decrease depending upon the amount of your escrow payments and your rate of interest. recommended you read of interest is based upon the existing Federal funds rate as well as your individual situations, such as your credit report, earnings, as well as financial debt to earnings ratios. These elements may not impact your home loan settlement.

The most typical sort of home mortgage is the fixed-rate home loan. This sort of mortgage includes a fixed rate for the whole size of the car loan, yet the rate of interest will certainly vary periodically. While a fixed-rate mortgage may be less costly in the short term, the rate of interest will boost with time. A 30-year fixed-rate home loan will allow you to pay much less passion over the term of the lending. Yet understand that the month-to-month settlement will be higher than if you were to select an adjustable-rate mortgage.

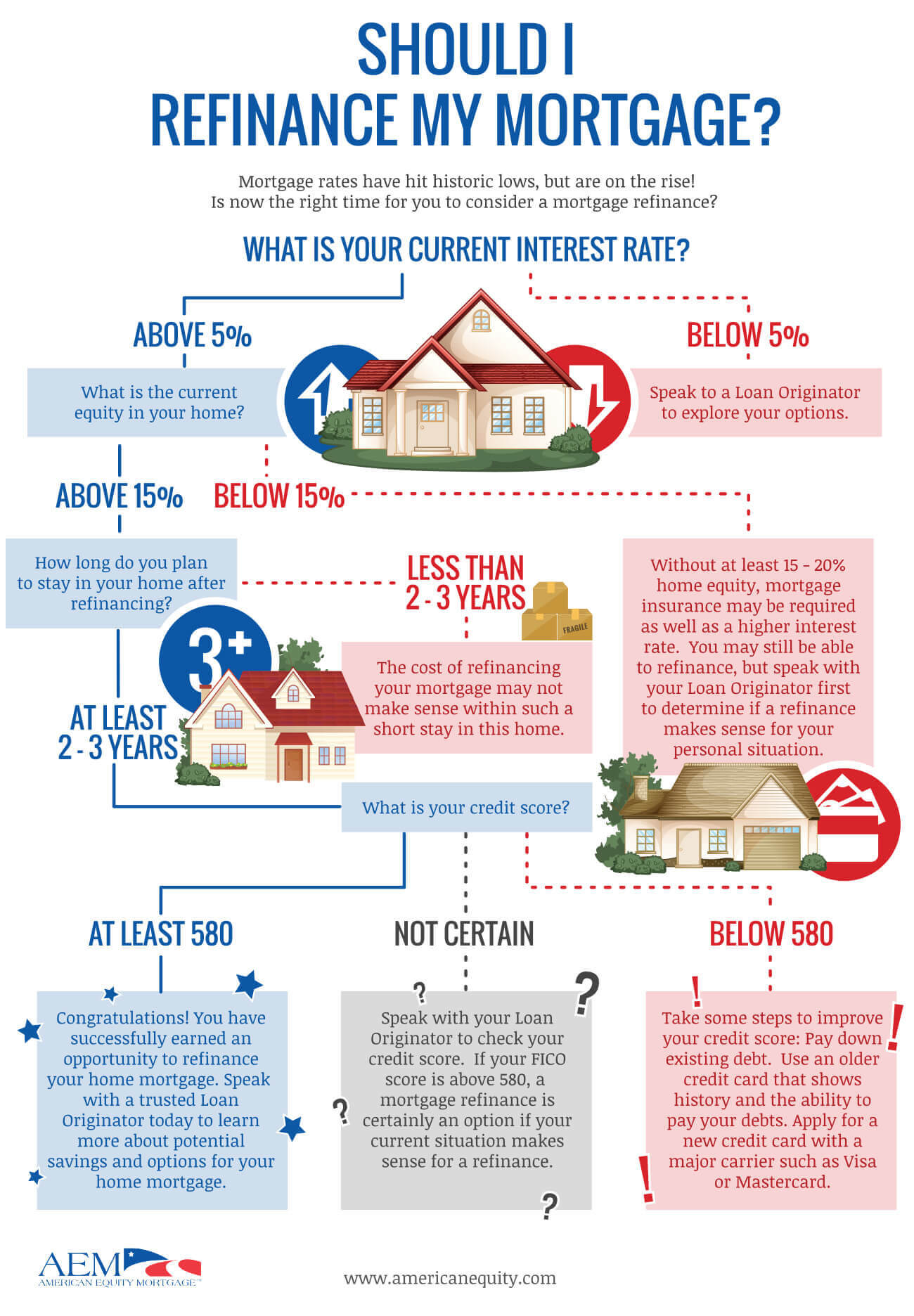

Rates of interest are low across the board, with the majority of debtors obtaining rates around 4%. Nonetheless, these rates can differ substantially depending upon the borrower's credit history, debt-to-income ratio, and also car loan quantity. Lower rates of interest are more likely to be readily available to people with stronger personal monetary situations. If you plan on refinancing your home mortgage, make certain to consider added closing prices. These fees will certainly boost your total home mortgage settlement, but will be worth it over the long run.